How to Build Wealth From Nothing With 10 Steps

Share this content :

Do you ever wish that your life was a rags-to-riches story? You’re not the only one. Several people spend a lot of their time wishing for the chance to become rich. Whether they look for a lottery ticket or a bachelor’s degree, they all want some pathway to making money.

However, here’s a secret that you might not realize: you have the power to make your wealth. You might scoff and think that it’s impossible to make money, let alone the amount you want to have. While it is hard, it’s not unrealistic. If you look at the billionaires of today, like Warren Buffett or Michael Dell, you’ll find that they didn’t make their wealth overnight. It took them several years to amass a fortune.

Here’s another thing you might not realize: you can start building your fortunes now. Some people will complain that you might not be ready. However, those who take risks will have a better life. If you want to take a risk, you’ll quickly discover how to build wealth from nothing. Here are ten steps to help you on that path.

What are the steps on how to build wealth from nothing?

Step 1: Build the right mindset

The first step to any endeavor is to have the right mindset. Many people often complain or worry that they won’t make enough money. These people might be too focused on bills or feel anxious about investments. You might be like them in how you see your chances of earning wealth.

Now, I’m not denying that these fears are valid. Having spent my childhood in the projects and seeing my family struggle to make ends meet, I know how tough it can be. However, as time went on and I gained more experience, my mindset changed. I realized that no matter what your background is, if you think you can, then it can happen.

That’s why I believe you need to review and reassess how you see things. If you constantly tell yourself that making money is difficult or impossible, then it will be. However, the inverse is true as well; if you push yourself to do better and believe that you can learn how to build wealth from nothing, then it’ll come true.

How can I start?

To get your mindset in the right direction, focus on having a positive response to everything. More often than not, people can smile and say all is fine until they face a challenge. For example, you might look at your existing student debts or house loans as a blockade. Instead, take it as a positive challenge. If you pay off these debts as fast as possible, then you’ll overcome a big obstacle. In other words, don’t despair at what faces you. Focus on what it is and how you can overcome it. Once you start to see all your limitations as challenges, you can take the steps to charge forward.

Step 2: Focus on effective money management.

“Give a man a fish and you feed him for a day. Teach a man to fish and you feed him for a lifetime.”

If you look at the proverb above, it immediately explains why money management is essential. You see, people like to imagine that if they got a million dollars, either from inheritance or from the lottery, they can become wealthy. Now, while those options give you money, it’s what you do with it that matters.

Think of Warren Buffett, the world’s richest man. The Oracle of Omaha is a brilliant investor and consistently works to trade or buy stocks. For him, it’s not about being rich; he doesn’t drive limousines or live in a five-star high-rise apartment. Buffett focuses more on how he can build his money and use it to make better investments. He doesn’t try to spend it with reckless abandon. Instead, he cares about what he can do with it.

The same should apply to you. Making money or earning a good salary isn’t the only answer. You also need to know how to handle it effectively. Sometimes, the best way to save more cash is by sacrificing a couple of luxuries. You’d be surprised how much you can save when you avoid spending on snacks or fancy sneakers. In time, you can afford those luxuries. However, if you want to know how to build wealth from nothing, start by seeing where you can manage your money better.

How can I start?

A good rule of thumb is to write down all your finances. List everything in your account, from the salary you earn to the expenses you have. When I say expenses, I mean every single expense. Don’t focus only on your bills while saving some cash for your massages or jewelry. Once you have a comprehensive list, review it and then review it again. See which payments make sense and which ones don’t. You might surprise yourself by what expenses don’t matter in your lifestyle.

Step 3: Develop the roots of good wealth.

To make the most of your mindset, you need to start forming the right habits. Anyone can learn how to manage money, but making it a habit is more important. What’s the point of learning how to budget if you give in and make a lot of impulse buys?

When you want to develop the roots of good wealth, always focus on simple and manageable habits first. Don’t focus on building so much money that you can buy a Mercedes or Bugatti. Instead, think of what you want to satisfy you in the long run. Simple things like having savings or an emergency fund can be more satisfying than you think.

Once you do that, start working on the habits that fit your plan. Again, simple is better. For example, did you know that many people throw away or waste their change? A couple of dimes might not seem like much, but it’s that carelessness that leaves your money wasted. Instead, make a change by saving the nickels and quarters you get. If you put it all in a jar, you’ll start to see the money grow over time. Sooner or later, those nickels and quarters start to become dollar bills.

How can I start?

Like the financial planner, start by listing down the habits you have. Look at anything related to money and see what you find out. For example, you might have these kinds of habits:

- I purchase any product I find on Amazon.

- I throw out the change I get, like dimes and nickels.

- I buy Snickers whenever I feel stressed.

Now, while these habits don’t seem so special, they can make you spend more or waste more over time. Once you spot the habits that feel dangerous, like buying online consistently or stress snacking, look for ways to curb that. Perhaps you can log out of your Amazon account or limit your purchases. Maybe you can focus on buying cheaper and healthier snacks, instead of getting more chocolate bars.

Step 4: Remember where you are.

To know how to build wealth from nothing, you must understand where you are. I’m not talking about the state or town you live in, though. I’m talking about where you stand financially. Being self-aware of how much money you have is essential. If you want to become a millionaire, you need to know where you stand. Once you know where your starting point is, you can start to build your money and move to the next milestone or level.

To know how to build wealth from nothing, you must understand where you are. I’m not talking about the state or town you live in, though. I’m talking about where you stand financially. Being self-aware of how much money you have is essential. If you want to become a millionaire, you need to know where you stand. Once you know where your starting point is, you can start to build your money and move to the next milestone or level.

How can I start?

Examine everything in your finances, including your interest rates and existing debts. Once you know what your financial situation is, you can start to make the changes you need. For example, you can look at your app subscriptions and see which ones are still active. If you signed up for an app that you rarely use, it’s better to cut ties and avoid wasting the fee.

Step 5: Establish the right skills.

Learning habits, like saving $20 every week, can set the ground for more important things. In particular, it can help you prepare to learn about the skills you need to manage your money. When I talk about skills, I’m specifically talking about special methods and approaches to life. While a habit can be learned, a skill must be mastered to work.

For example, learning how to compile a grocery list and a budget is good. Now, you can take a step further and start learning how to set budgets for other things. For example, you can start to budget the money you need to buy your ideal house. You can set budgets to accommodate new projects, like a master’s degree or a side hustle. By learning new skills that improve your habits, you can do a lot more for yourself.

How can I start?

Learning a skill of any kind takes time. Teaching a man to fish isn’t going to be an overnight lesson, right? In that same manner, financial skills like budgeting and stock trade will demand your time and attention. Do yourself a favor and dedicate some hours of your day to learning the skills you need. Sure, you can enjoy sports or racecar driving, but surely you can do more with that time, right?

Step 6: Be responsible.

You must become responsible for all facets of your life, not just financially. At the end of the day, you are in charge of the lifestyle you have. People can advise you or suggest ideas to you, but there’s only one person who makes the final choice: you.

So, if you want to learn how to build wealth from nothing, you must be responsible for the effort you put into it. Studying finance and training yourself to avoid impulse spending is your choice. Dedicate some time to what you need to learn and see where you can improve.

In addition, be prepared to face the consequences. If you make a mistake, don’t be afraid to own up to it. Remember, mistakes can happen and we’re all human. We’re not born perfect. However, we can still grow to be better and greater.

How can I start?

Believe it or not, being responsible is also recognizing that there is no excuse. There are many ways you can achieve what you want, and many of them are accessible today.

For example, you want to start learning about the stock market but you know that buying books is too expensive. To get around this, try the local library. They usually have hundreds of books about financial management and strategies. Plus, you could access their computers to search for important articles or videos on the stock market. There are a lot of learning materials available to us today. It’s our job to find them and make the most of them.

Step 7: Set your goals.

At this point, you’ve understood the power of mindset, habits, self-awareness, and skills. Surely, you should be done, right? Not so. You see, learning all this is useless if you don’t goals to aim for.

You could say that getting rich is a goal, but that’s quite vague. When I talk about goals, I like to be specific about what I want. For example, if I want to buy a house, I make sure to write both the goal itself and the reason why. By knowing why I want to achieve it, I can motivate myself to do better and succeed. Alternatively, I can also reassess and discover that my reasons might not matter in the long run.

You can do the same for yourself. Start by setting goals and establishing what makes them important. For example, you can choose to take a bachelor’s degree at your local university. However, why would you do that? You might say that you want to expand your skills or improve your knowledge. Once you write those down, you can manifest your desire to succeed. And who knows? You might look back one day and be surprised at how much you have accomplished since.

How can I start?

Again, I emphasize the power of writing. In my opinion, writing down all your thoughts and ambitions is a good way of assessing yourself. By writing it down, you can see what your aims are and if they make sense. Sometimes, we have goals that sound a lot better in our heads than in real life. Once it’s written, you might be able to find out what goals fit your agenda and what won’t.

Step 8: Find the “how” for your goals and plans.

Now that you know what your goals are, it’s important to put the plan in motion. When learning how to build wealth from nothing, you need to establish the modality of your plan. Like how Amazon places a step-by-step procedure for buying, packaging, and delivery, you need to set out a process too. In simpler words, you need to find the “how” in your plans.

The way you choose to reach your financial goals is entirely up to you. However, don’t assume that there’s only one path to success. Believe it or not, some people became millionaires by mowing lawns and driving buses. It’s a shock, but the fact is that they knew what to do with their cash. Driving for years can still make enough money when you dedicate a large portion to saving and investing.

So, when you decide to go and make money, remember that your pathway doesn’t have to be like others. You might dedicate yourself to an online business that you run on Facebook or Twitter. You could spend your time working as a freelancer and networking with lots of companies. How you choose to do so is up to you, as long as you know what you’re doing.

How can I start?

Sometimes, establishing the pathway to success is vague. It can be tough to find the route that feels best for you. If you struggle with that, take some time to research the people you idolize. Look at role models within your field, whether that’s a professional athlete or a local chef. See what they did to make a living. By learning their process and experiences, you can start to apply that to your own life.

Step 9: Learn to master your craft.

If you look back at the fish proverb, you’ll remember that teaching a man to fish will feed them for a lifetime. However, don’t think that means the lesson will only take a day or a month. What you need to remember is that it takes time to master a skill. You could spend years on a specific craft and still find new things or lessons from it.

One thing I want to emphasize is the power of failure. In our society, many people are afraid to make mistakes or fail. And sure, not being successful can hurt or damage your pride. However, what you should remember is that failures can be the best lessons in life. I have made multiple businesses in the past and many of them did not pan out. However, I know now in hindsight that they helped me understand what I can do and how I can do things better.

The same goes for you. When it comes to anything you want to do, from selling coffee to growing trees, you have to be ready to try and fail. If you do mess up or make a mistake, learn from it. Use that knowledge to propel yourself even further. That way, you’ll be able to look back and discover how far you’ve gone and how much you’ve learned.

How can I start?

Envision your future first. If you want to retire at the age of 30 and live off your funds, then look at how you can get there. The same goes for anyone with any endeavor planned. You might want to start investing in the stock market or you might want to buy a house and pay off the mortgage. In all cases, you need to envision your future first.

Once you have that all in mind, practice and review your skills. One trial or one lesson will never be enough. So, dedicate your time to learning more and understanding your craft better. See what works for you and what doesn’t. Examine the different paths you can take and which ones sound ideal for your lifestyle. The more you try and learn, the more you grow to appreciate your craft.

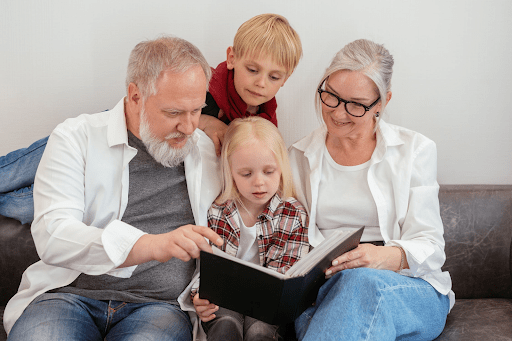

Step 10: Build your legacy.

Let’s say that you’ve achieved everything you have ever wanted. Following the mindset you started with, you’ve grown in skill and money. You’ve done what you used to think was impossible: learn how to build wealth from nothing. And now you have gained all that you’ve ever wanted. Here’s the question, then: what will you do with it?

Many people get stumped by this idea, most likely because they either didn’t expect to get there or plan for it. However, I believe that you should plan for what you can do for your legacy after. There are ways you can make the money you have now or in the future mean something later on.

Start thinking about that now so that you won’t waste the fortune you build.

For example, you can work out ways to use that money for your kids. With it, you can provide their college education and help them build the skills they need to grow later on. You can also dedicate your money to charity or to loved ones whom you want to care for.

How can I start?

The best way to start on your legacy is to see how much money you need. If you earn X amount of dollars, what will you do with it? For example, if you’ve saved up to one million dollars, what’s your plan? You could dedicate portions of it to your family, to the house ownership, and to any insurance policies you have. You could also look for new investment plans, side hustles, or retirement funds to direct that money to. By learning how to build wealth from nothing, you can start looking toward the future and the life you want for yourself.

Did you learn something from this article? You can help others by sharing this post with your family and friends. And you can get my FREE book when you click this link. Learn practical tips on money management and how to become a millennial millionaire!

Share this content :

Copyright © 2023 Munif Ali. All rights reserved.