Five Things To Consider Before Buying Index Funds

Share this content :

With the recovery of the stock market, buying index funds mainly started getting into the limelight once again. But how do index funds really work, and how do they help your money grow? Let’s take this example: companies belong to what we call an index. Whenever you cash in your money in index funds, that money is used to invest in all companies belonging to that particular index. In return, this gives you a more diverse trading portfolio than if you will buy individual stocks.

Now, I know this alone can be a lot to take in, especially for beginners, but I will explain it to you as we go through the article. You might say you’re not good with numbers, or you’re not good when it comes to business, but that’s why I’m here to help you understand the concept of buying index funds in the simplest way possible. It doesn’t matter what line of career you are in right now. What matters is you’re here trying to learn more.

Here are the five things to look at before buying index funds :

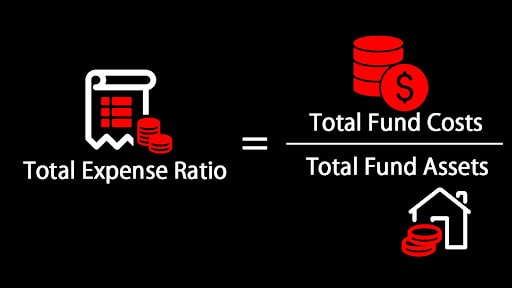

1. Expense Ratio (ER)

In order to measure how much of the assets of a certain fund is utilized for administrative and other operating expenses, we need to consider the expense ratio (ER) or sometimes known as the management expense ratio (MER). In technical terms, this is determined by dividing a fund’s operating expenses by the average dollar value of the assets under its management.

2. Tracking Index

A tracking index, sometimes called an index tracker, is designed to follow pre-made rules for funds to track a specified collective of underlying investments. Index securities must be held in the same proportions.

3. Minimum Investment

This is the minimum amount that you need to invest in a specific index fund that you want to be part thereof. Some funds require a minimum of 1,000 dollars, while others require $2,000 or $3,000 depending on the title or company. However, there are also index funds that do not require any minimum amount to start investing.

4. Inception

5. Holdings

Holdings simply mean the overall content of the investment portfolio of a certain index or entity. This is also an important factor to consider because it represents the volume of holdings that an index has contributed to the degree of its diversification.

Why are Index Funds Popular?

Index Funds offer attractive returns.

Index Funds are diversified.

It has a lower risk.

Since it has a lower risk, it has a low cost.

Just like any other stocks, major indexes will most like fluctuate. However, if an index funds has made solid returns over time, such as the S&P 500’s long-term record of about 10 percent annually, it can make such a good record. However, it doesn’t mean that index funds make money every year, but over long periods, that has been the average return. Most investors invest in index funds because they offer immediate diversification. With one investment, investors can own a wide variety of companies. For instance, just one share of an index fund based on the S&P 500 provides ownership in about hundreds of companies.

Since index funds are diversified, investing in them provides a lower risk than owning individual stocks. But that doesn’t mean you can’t lose money or that they’re as safe as a CD. Just like any other stocks, indexes can also fluctuate, but it’s a lot less than an individual stock. Index funds charge very little for the benefits mentioned above. It also comes with a low expense ratio. You might pay a small amount of $3 to $10 per year for every $10,000 you invested for more significant funds. One fund even charges you no expense ratio at all. When it comes to index funds, one of the most critical factors in your total return is the cost.

In addition to the information above. Here’s a FREE video to guide you in your investing journey, and if any of these information helped you, please do not hesitate to share or subscribe to our Youtube channel to learn more about personal financial development and have a financial freedom.

Share this content :

Copyright © 2023 Munif Ali. All rights reserved.