A Beginner's Guide to The Stock Market

Share this content :

Looking to dip your toes into the stock market? You’re not the only one! In 2022, 58% of Americans have invested some cash into the stock market. What’s more, 79% of postgraduates in the US are stock owners, a sign that the stock market can be a game-changer for your wealth. The only question now is where to start. To help you launch your investing goals, here is a beginner's guide to the stock market and efficient trading!

What is the stock market?

To start our beginner’s guide to the stock market, let’s understand exactly what we are dealing with. The stock market is where you can buy, sell, and trade the shares of various publicly-held companies. Shares are essentially pieces of ownership of each company. In other words, you’re buying a portion of the company.

Now, you might ask the beginner’s guide to the stock market how someone can profit through shares. Think of it like this: the better a company does, the higher its value is. As a result, any shares you buy or own cost more. When you have high-value shares, you can trade or sell them in the stock market to make a profit.

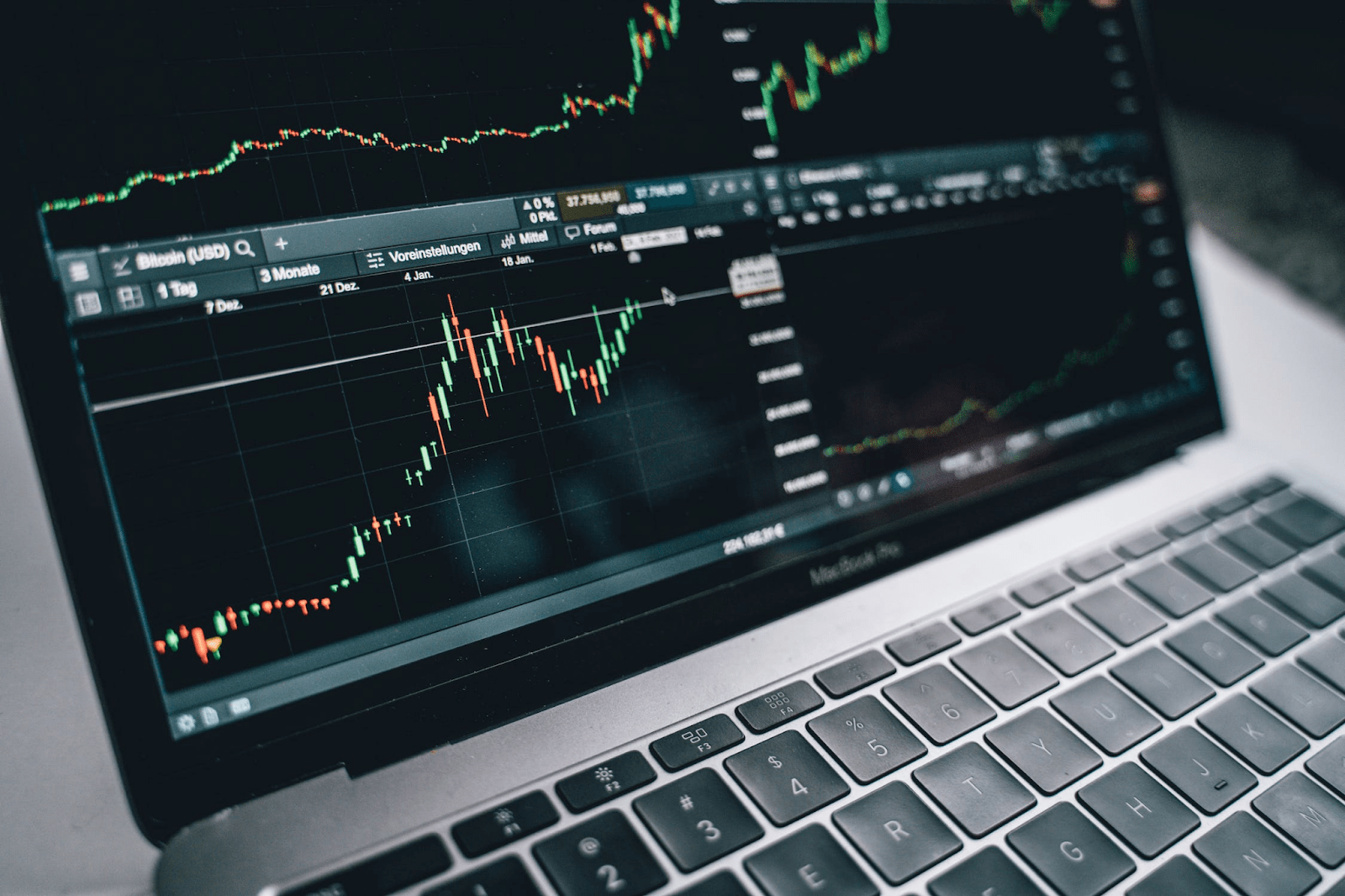

One more thing to consider is that prices fluctuate in the stock market. What may cost $40 now can fall to $20 over time. Conversely, a stock worth $30 can double in price. While this can be daunting for investors, it’s also a great opportunity to master the art of trade. With a beginner’s guide to the stock market, you can discover how to make each share into a valuable asset over time.

Why should I explore a beginner's guide to the stock market?

Think about this: the US stock market alone accounts for almost 60% of the entire world’s stock trade capital. With a beginner’s guide to the stock market, you can learn how to turn it all into a reliable source of income. Here are some benefits you gain when you dip into the world of stock trade!

You can build wealth over time.

One of the best things about the stock market is that you can build your wealth over time. Contrary to popular belief, investors shouldn’t try to make a quick buck in a hot moment. It’s about the long game and holding the value of your stocks.

Through a beginner’s guide to the stock market, you can use the shares bought to amass wealth in the future. Over time, you can build these shares to cover your savings and provide financial stability for your family. Plus, you can start investing without spending on commissions!

You gain “liquid” assets.

One of the most crucial aspects of stocks and stock trade is its potential to be “liquid”. Liquidity in stocks happens when there are many buyers and sellers available for that share. In the stock market, you’ll find lots of people willing to make a deal for your assets. This is much faster than other assets, like real estate or car sales, where negotiations can take a while. Plus, you can use a beginner’s guide to the stock market to process the payoffs quickly!

You create a stream of passive income.

Through a beginner’s guide to the stock market, you’ll discover that many companies pay dividends. These are portions of their profits paid to shareholders, sometimes quarterly and other times monthly. Through dividends, your shares help you sustain money over time. It’s passive income, one that you don’t need to watch 24/7 to grow or cultivate. This can help you fund your other investments, like homeownership, in the future!

What should I do to trade in the stock market effectively?

Now that you know why a beginner’s guide to the stock market can aid you, it’s time to dip your toes into the trading world. The stock market can be scary at times, especially when prices change and trends shift. The good news is that there are seven proven ways you can learn how to trade effectively!!

1. Study your investments or interests.

A rule of thumb for any up-and-coming investor is to know what you’re paying for. Even if you have a beginner’s guide to the stock market, the best way to invest is to understand your investment. That’s why you should only buy shares of companies you know well. Don’t just pick the popular brands because they look good; you must know how they operate and manage their affairs.

If you’re not sure where to start, look into industries and organizations that you’re familiar with. Take time to examine their history and their approach to business. Stay on the pulse of any current trends that can affect these businesses. That way, you can arm yourself with enough information to make a calculated investment!

2. Compound investments through the dollar-costing average (DCA).

Dollar-cost averaging (DCA) is one of the best ways to grow value over time. Here, you regularly invest the same amount of money at a consistent intervals. For example, you could buy $150 worth of a certain stock every month. If the value goes higher, then you’ll get fewer shares; if the value falls, you get more shares.

So, why would a beginner’s guide to the stock market recommend DCA? It’s because this strategy allows you to mitigate the risk of a volatile price. Regardless of how high or low the price gets, consistently investing that amount of cash will make each share cost less on average. Essentially, you build a lump sum of shares that can make more value in five years than in one profitable year. It’s a time-tested method that can help you in the long run!

3. Explore different investment platforms and programs.

The digital age has made modern stock trading much more accessible for everyone in the country. With your phone and a beginner’s guide to the stock market, you can quickly download apps to help you track market trends and buy shares. However, if you want to do things properly, you need to examine different platforms and programs. The right one can help you start from scratch and guide your investing habits accordingly.

For example, one of the most popular stock trading apps is Robinhood. The company has an online app that you can use to make commission-free trades in the stock market. The official site states that you can invest in over 5000 different securities, including stocks and exchange-traded funds (ETFs). You can even access American Depositary Receipts (ADRs) for over 650 global companies!

4. Diversify your portfolio.

Every beginner’s guide to the stock market will always preach the word “diversification”. This is when you invest in different shares and stocks in multiple industries and areas. The reason behind it is simple: you don’t want to put your eggs in one basket, especially for stocks in a volatile market. By spreading out your investments, you can stay financially safe even if one stock plummets dramatically.

5. Focus on long-term investments

Throughout this beginner’s guide to the stock market, we’ve mentioned that stocks are for long-term investment. The reason why is that the stock market does increase in value over time. Even when prices fall or inflation hits, shares do grow in value as time passes. By compounding your investments, you can ensure a steady stream of valuable assets for many years to come. As Warren Buffett himself stated, “If you aren’t willing to own a stock for 10 years, don’t even think about owning it for 10 minutes.”

6. Monitor your investments regularly.

While it’s crucial to keep your shares as long-term investments, that doesn’t mean you leave them alone for several months. Regularly monitoring your assets can help you determine the market trends to see when it’s time to sell or invest more.

For example, we’ve mentioned in this beginner’s guide to the stock market that prices do fluctuate over time. There might come a point when a high-value stock starts to fall in value. If you keep an eye on the trends, you can make a profit by selling them when necessary. While this takes years of experience to master, it’s always worth considering!

7. Always look for professional advice and information.

So far, this beginner’s guide to the stock market has introduced key concepts like liquidity and compound interest. However, if you want to gain more knowledge, you need to learn from the experts. Financial geniuses like Warren Buffett have spent years examining and working with the stock market. Take time to study their mindset and see how they operate.

If you want further financial advice, you can also seek the help of a professional consultant. These people have all the latest market news and insights into the stock trade. You can use their input to plan your next step and make a profit. You can also examine financial blogs, including this one, to learn more about different stocks and assets!

Takeaways:

- A stock market is a place where you can buy, sell, and trade shares of various publicly-held companies.

- Profits come from selling high-value shares, which grow in value as the company performs well.

- The stock market offers a chance to build wealth over time, gain “liquid” assets, and create a passive income stream.

- To trade effectively, first study and understand your investments.

- Use the dollar-cost averaging (DCA) strategy to grow your investments over time by regularly buying a fixed amount of a particular stock, regardless of price.

- Different investment platforms can offer various benefits, so explore your options.

- Diversify your portfolio to protect against significant losses and ensure a balanced investment.

- Focus on long-term investments as the value of stocks typically increases over time.

- Keep a regular eye on your investments to stay on top of market trends.

- Always seek professional advice and stay informed by following experts and financial resources.

Share this content :

Copyright © 2023 Munif Ali. All rights reserved.