4 Tricks To Maximize Tax Deductions

Share this content :

Have you ever felt that you were paying too much for something? Many people complain about their taxes and wish they wouldn’t spend so much. However, what they don’t realize is that they might be paying the price in more ways than one. Studies show that Americans earning less than five-figure incomes are subject to an effective payroll tax rate of a whopping 14.1%!

Sounds unfair, right? Thankfully, there are ways to help you fight against this kind of cost. Tax deductions can help you reduce the amount you lose and keep your wallet satisfied. To understand this better, let’s examine what tax deductions are and how they operate!

What are tax deductions?

Before focusing on tax deductions, let’s examine what tax benefits are. Simply put, these are laws where you can reduce the amount of taxes owed provided that you meet certain requirements. There are three types of benefits you can gain: tax credit, tax exclusions, and tax deductions, our topic for the day.

Tax deductions are the amount you can remove from your taxable income. By having tax deductions, you can lower your overall expenses safely and legally. Furthermore, you can choose what type of tax deductions fit your income and lifestyle. Examples of tax deductions include mortgage interest, student loan interest, and medical expenses.

One thing to note about tax deductions is that they are closely monitored by the Internal Revenue Service. Miscalculations or false claims will lead to an audit, putting you in a precarious situation. If you want to make the most of your tax deductions, make sure you calculate the information correctly.

What are the types of tax deductions?

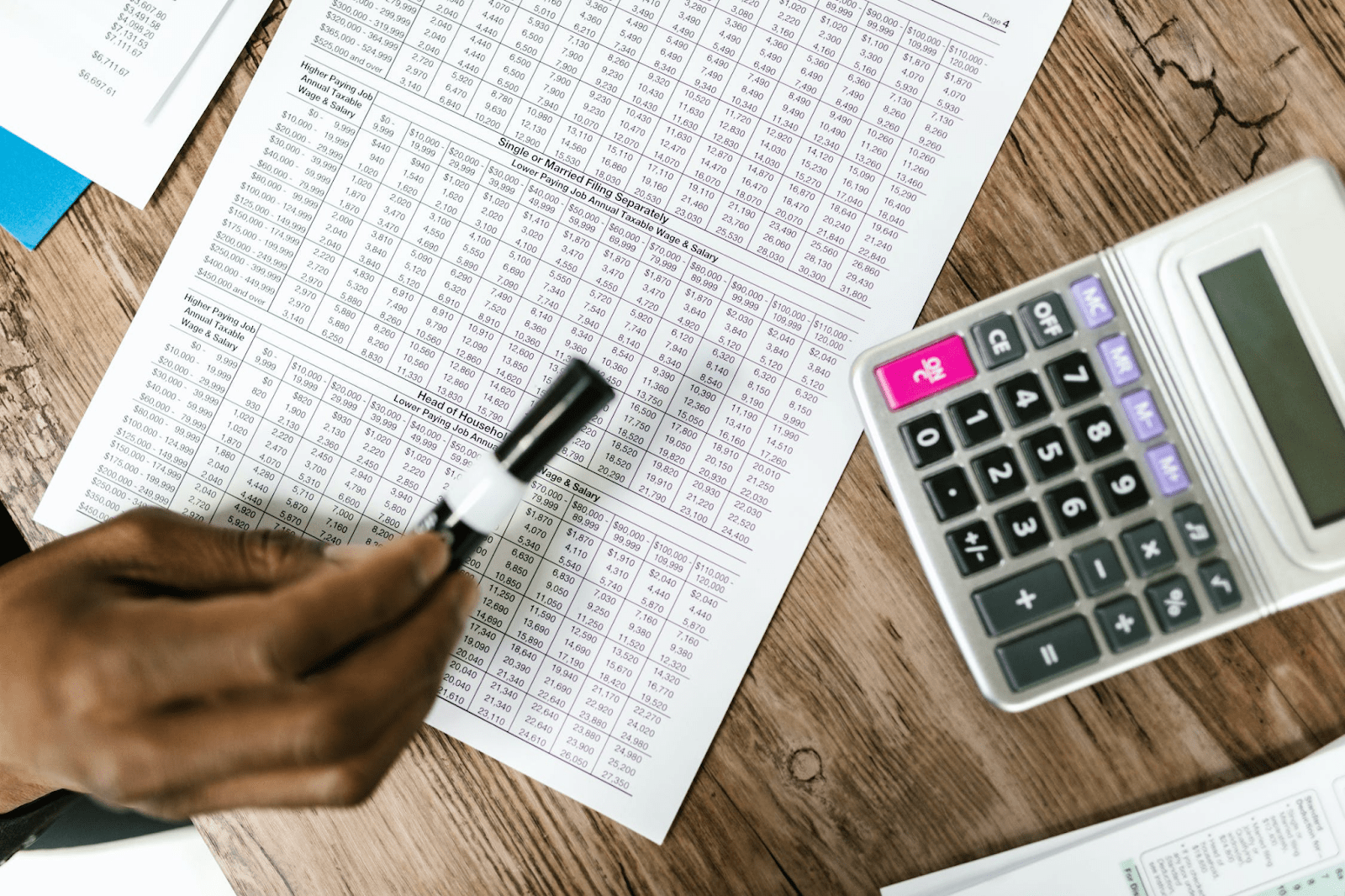

Knowing the right tax deductions to make can save you money and keep you from stress. There are two types of tax deductions you can make: standard deductions and itemized deductions.

Standard tax deductions

These are fixed amounts of tax deductions that you make according to your filing status. Regardless of any life changes, as long as your filing status remains the same, then you’ll be paying a specific amount.

For example, a married couple filing together can earn a deduction of $27700. As long as they can qualify for these requirements, they can use these tax deductions to help plan their financial goals better.

Benefits

Firstly, standard tax deductions are set in stone. This allows the taxpayer to calculate their deductions quickly, saving time and energy. In addition, you can upgrade your deductions based on key filing information. For example, becoming head of a household can give you as much as $20800.

Drawbacks

Since standard tax deductions are set at a specific amount, you might be short-changing your calculations. Depending on how much you spend, you could qualify for more deductions if you itemize. Plus, there’s no guarantee that your deductions will cover enough expenses to help you out.

Itemized tax deductions

These are tax deductions that allow you to specify and differentiate your situation from other taxpayers. No one has the same formula for their lifestyle costs, which can be difficult when you use standard deductions. Itemized deductions focus on all applicable tax deductions, rather than sticking to a set amount.

For instance, if you use standard tax deductions as head of a household, you qualify for up to $20800. However, if you use itemized deductions, you could potentially get even more!

Benefits

Compared to standard tax deductions, you can qualify for multiple benefits at the same time. For instance, if you pay for a mortgage and make charitable donations, you can avail of a higher deduction amount.

Furthermore, itemized tax deductions can also give you refunds for certain qualifications. For instance, H&R Block revealed that being in the 15 percent tax bracket can allow a $150 discount for every $1000 in itemized deductions!

Drawbacks

On the one hand, itemized tax deductions allow you more benefits. On the other hand, it requires careful calculations. If you choose to itemize your tax deductions, you need to consider all qualifications and crunch the numbers.

Plus, the IRS has several requirements for certain itemized deductions. There’s always the possibility that your itemized deductions are not as fruitful as the standard deductions.

How can I maximize tax deductions?

Now that you know how tax deductions work, it’s time to use them to your advantage! The key to maximizing your tax deductions is knowing how and where to use them. Here are four ways you can master these benefits and improve your finances!

1. Save for retirement.

Experts recommend using tax deductions for your retirement plans. While there are many retirement options available, you can use specific ones that reduce your taxable income.

For instance, 401(K) plans can make pretax contributions of up to $22500. Meanwhile, Individual retirement accounts (IRA) allow the same benefits for those without a company-sponsored plan. However, they use after-tax dollars so they won’t yield the same amounts.

Even if you don’t have a retirement plan, it’s always good to explore your options now. Saving for retirement is a great way to outline your financial goals, especially if you start years in advance. Plus, by using tax deductions, you can keep your goals within reach at any age!

2. File your taxes ahead of time.

Aside from using your tax deductions for retirement, there are plenty of other options to qualify for. Things like mortgage plans and student loan interest rates can change how much money you save. However, before you explore these options, you should consider how much your tax deductions are. Remember, a bad calculation can bring the IRS to your doorstep.

To be safe, calculate your tax deductions ahead of time and get your files ready before the next deadline. Whether you pay quarterly or annually, being prepared is always a smart move. Plus, it’s easier when you know you have all your documents ready for a quick and easy taxpaying process.

3. Consider a flexible spending plan.

Making the most of tax deductions can require out-of-the-box thinking. Some companies offer flexible spending plans to help their workers store money for things like medical expenses. Through a flexible spending plan, you can set up contributions to pay for specific needs. However, your amounts can be forfeited if you don’t meet the eligible expenses by the end of the plan.

Before diving in, see your financial plan and if this can help you save more money in the process. Flexible spending plans can yield good tax deductions if you can meet the expenses needed. Remember, it’s better to know all options on the table before you make your final decision.

4. Ask for advice from a tax professional.

Ultimately, making tax deductions can be a tiring and time-consuming process. If you’re not sure about what to do, try consulting with a professional. Remember, there are certified experts who know more about the ins and outs of tax deductions than you can imagine. A second opinion is always helpful, especially when it’s someone who has helped first-time taxpayers or those looking to boost their finances!

Takeaways:

- Tax benefits are ways to legally reduce your taxes, with tax deductions being one of the key types.

- Tax deductions reduce your taxable income, potentially saving you money on taxes.

- Common tax deductions include mortgage interest, student loan interest, and medical expenses.

- Deductions are closely monitored by the IRS, so you need to be careful and accurate when claiming them.

- You can choose between standard deductions (fixed amounts) and itemized deductions (specific expenses). Each option has its benefits and drawbacks.

- Standard deductions are fixed and depend on your filing status, making them simple and predictable but potentially less beneficial.

- Itemized deductions allow for a more personalized approach, potentially maximizing your savings, but they require detailed record-keeping and calculations.

- To maximize your deductions, consider saving for retirement, filing your taxes ahead of time, considering flexible spending plans, and seeking advice from a tax professional.

Share this content :

Copyright © 2023 Munif Ali. All rights reserved.