Why Do You Need A Credit Card? 5 Reasons To Get One and 5 Reasons To Avoid

Share this content :

“Cash or credit?”

I bet you’ve heard this phrase at least once in the past year, let alone the past decade. As simple as it sounds, choosing whether or not to go with credit has been a big debate for so many years. There are thousands of people who see a credit card as the greatest investment to ever make. At the same time, there are thousands who see a credit card as the first step to a financial crisis.

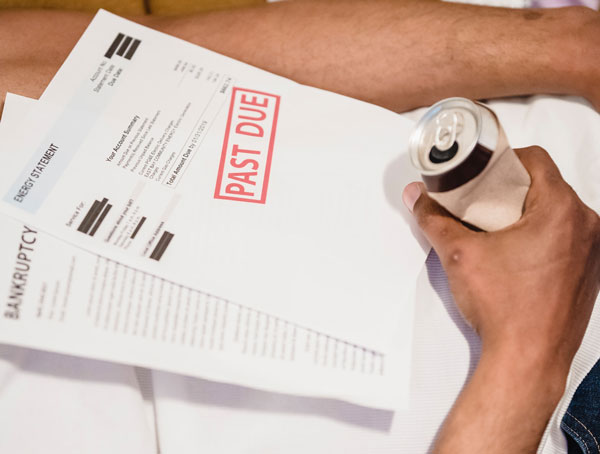

The fact is simply that credit cards can be a powerful game-changer in your life. In the right hands, it can be used as an effective way of paying your bills and your purchases. However, when used wrong, it can lead to heavy debts and overdue payments. Ultimately, the question that one should ask is “Why do you need a credit card?”.

To help you see whether or not it’s worth the risk, here’s what you need to know and why do you need a credit card.

What is a credit card?

Put simply, a credit card is like the advanced, technological version of an IOU. It allows you to make purchases that you can pay for later, specifically when you cover the credit card bill. This way, you can make your most important and expensive decisions, such as paying off mortgages or getting house repairs, without having to spend the cash right away.

Alongside a credit card, you’ll be given what is called a “credit score”. Essentially, it’s a score that tracks how often you use your credit card and how often you cover your due billings. As long as you pay on time, your score goes up. Get it high enough, and you’ll be eligible for various financial options, including personal and business loans.

Why should I get a credit card?

Now that you know how a credit card works, you might have an idea of why it’s so beloved. People enjoy using credit cards because of how easily it replaces traditional bills and improves the debit system. If you’re wondering why you need a credit card, here are five reasons that might change your mind.

1. You can easily track your expenses.

Because all credit cards are electronic, that means all your expenses and charges are recorded too. This allows you to keep track of your previous spending habits through credit card statements. You can get one each month to see what you’ve bought and what you spend the most cash on. It’s like having an automated accounting system; it only takes one swipe to get the deal on paper (or screen).

2. You can use it in most, if not all, businesses.

As the world becomes more electronically and digitally connected, so do businesses. Places like cafes, restaurants, clothing stores and even lemonade stands allow you to pay for any purchase online. With credit cards, you can have an easier time going to any store in your town or city and paying for what you need. Whether you buy power tools or scented candles, a credit card can be used in most, if not all, kinds of shops.

3. You can transfer your debts with no extra pay.

Let’s say that you have an outstanding debt for buying a car or making use of a loan. Usually, you’ll have a certain annual percentage rate (APR) that bumps the price up for each payment. It’s the cost of doing business, and while it can seem unfair, it’s a regular part of any transaction.

Now, say that you transfer your balance, including your debts, from one credit card to another. Through a balance transfer, you can actually save money. If you go to a card that has a lower interest rate, sometimes even 0%, then you won’t be forced to pay beyond the usual. While this doesn’t remove your debt, it does make the repayment process much easier.

However, remember that there is a certain amount of balance that you can transfer. It’s not a guarantee that you’ll be able to pay off all of your debt without interest. That said, if you can manage even a portion of it with little to no APR, you’ll find the credit card to be a handy investment.

4. You can maintain it for less money than other options.

Even with all these advantages, you might still ask “Why do you need a credit card?” After all, cash is still an option and you can always use a debit card. To fully understand its usefulness, let’s examine all three options.

Firstly, there are three primary payment options available today: traditional bills, debit cards, and credit cards. If you look at the first two, they require individual receipts and transactions for each purchase. Paying with cash means you’ll have to manually withdraw it from your bank or ATM, then see each of those bills go away for some other purchase. While a debit card allows online purchases, you’re going to be charged for every single option. What’s worse is that you might not even know how much your available savings are until you use it all up.

Compared to those two, a credit card allows you to cover all of your bills with a monthly or annual fee. Though it may cost a lot, it already covers every possible expense and spending limit you have. In other words, whether you buy only a handful of items or a storage unit’s worth, your credit card billing will cover it all. Better yet, you can even adjust how much you spend on the credit card to avoid going over budget.

5. You can have better protection against theft and fraud.

If you examine the three payment methods again, you’ll find that both bills and debit cards can lose money instantly when they are stolen. What’s worse is that it can take a while for you to even notice the damages, whether you check your wallet or your savings account. While a debit card’s money can be restored, it can take a while as the bank investigates.

However, if you have a credit card, you can get immediate notifications of an ongoing purchase. Online banking systems allow you to review any payments that happen under your account. You can notify the bank of any purchases that weren’t made or are untrue, and they’ll be removed from your billing. Plus, in certain banks and networks, you can receive zero liability for any unauthorized purchases. In other words, you won’t be forced to pay for something you didn’t agree to.

Why shouldn’t I get a credit card?

As you can see, there are many benefits and advantages when using a credit card. So, you might be thinking that it’s a done deal; you might be tempted to walk away to get enrolled for a credit card plan at this very moment!

Well, before you leave, you should remember that even credit cards have some setbacks or issues. There are plenty of reasons why people would still ask “Why do you need a credit card”, after all. Here are some reasons why you wouldn’t want to have one with you.

1. You might be tempted to overspend.

Let’s review how a credit card is used. In essence, you swipe your card and the cost gets charged on your bank statement. Once you pay your monthly or annual billing, all that cash is covered. Simple, right?

Unfortunately, it’s because of the simplicity that makes it so dangerous. People can easily get tempted to charge whatever they want to a credit card. It’s why you’ve seen kids online using thousands of dollars for video games or expensive meals. Some believe it’s because credit cards are so fast and easy to use. Others say that it’s due to the lack of a savings account or visible bills, like what you’d see in debit and cash. Either way, the swipe of your credit card can be easily abused and overused.

2. You might be subject to interest rate increases.

Using a credit card can be manageable and fun, as long as you pay your due amount. Whether it’s a minimum balance fee or monthly billing, all your power hinges on that one necessary payment. So, what happens if you miss or underpay the cost?

Say that you overslept and you miss your chance to pay the bank, or that you’ve had to cover so many bills that you can’t afford your usual rate. Well, the bank has now seen you’ve missed your credit card dues. Now, they have the power and excuse to start charging you interest rates. What’s worse is that some people can be charged as much as 30% interest within a short time. That’s a big jump in price especially if you already struggle to meet your credit card payment.

3. You might hurt your credit score more than expected.

If you go further down the rabbit hole, missing your on-time payments can be a serious problem. Not only does it give the bank reason to charge you more, but it can also damage your credit score. People have reported instances where their scores go down by as much as 100 points, simply because they missed the deadline. This means that you lose credibility with the bank, which can make loan applications even harder than they have to be.

4. You might end up adding more debt to your life.

The last quarter of 2020 marked the first time in history when student loans outranked credit card debts. In previous years, debts were manageable, and sometimes even easy to cover. Nowadays, especially with the rise of inflation and the recent pandemic, college student and graduates are left with tons of debt to cover. Recent graduates leave college strapped with tens of thousands of dollars in debt. That’s not even considering other potential debts, including loans and mortgages.

So, if you want to have a credit card, it’s highly recommended to review your existing debts first. Otherwise, by enrolling in a credit card plan, you risk adding even more debt to your portfolio. Plus, if you consider this with the interest rates and the credit score issues, it can lead to the last problem.

5. You might not be able to afford one.

Ultimately, if you ask yourself why do you need a credit card, you might be asking due to the cost. Even if you finally earn enough money to secure one, you have to consider what you can afford. With bills, loans, debts, mortgages, and other expenses in your life, is a credit card worth the extra effort? In certain cases, it might be a life-changing yes. However, more often than not, it’s better to avoid a credit card when you can barely afford the rest of your lifestyle needs.

How do I know if I need a credit card or not?

Not in a rush to get a credit card anymore? You wouldn’t be the first. Qualifying for a credit card is an achievement, but using one is a big responsibility. You have to consider the pros and cons before you can even commit to it. If you’re still unsure of its worth in your life, here are three useful tips to help you see if you need a credit card or not.

Check your financial discipline.

First of all, you need to review your own spending habits and budget control. Are you the kind of person who tends to splurge, even when they try not to? Or are you someone who is stringent on how much they spend, down to the last penny? By knowing how financially disciplined you are, you can see the likely path a credit card will bring. Those with good impulse control and restraint can make good use of a credit card, while those with on-the-spot spending habits might only suffer.

Research how credit cards work.

So far, you’ve read about how credit cards work in general. You know that they come with statements and that each due payment must be met to keep a card effective. However, even with these general details, there are many other terms and conditions to consider. Some banks offer zero liability for fraud, while others are more lenient to lower credit scores. Do yourself a favor by researching what local or statewide banks fit your needs. If none seem to meet your concerns, it’s better to refrain from a credit card altogether.

Examine your income and expenses first.

Lastly, there’s the simple issue of affordability. Can you pay for your credit card bill along with all your other bills or needs? To answer this, you need to look carefully at your current job and salary. You also need to see your lifestyle choices. Do you spend a lot of money to enjoy your life or explore the world? Do you make enough cash to build decent savings, perhaps even an emergency fund? Once you know how financially secure, you can decide then if a credit card is worth the risk or not.

Share this content :

Copyright © 2023 Munif Ali. All rights reserved.