5 Amazing Breakthroughs In Financial Technology

Share this content :

The late, great Stephen Hawking once said, “Intelligence is the ability to adapt to change.” That may be why financial technology has grown so much in the past decade. Financial technology has become a vital asset in our day-to-day financial lives. From the way we do transactions to the way we track expenses, it helped us learn how to be smarter with our money. So, let’s take a look at five amazing breakthroughs in financial technology and how they’ll redefine our spending habits!

What is financial technology?

Financial technology, also known as “fintech”, is an industry that focuses on using technology to improve financial services. Businesses around the world try to find new and innovative ways to make our spending habits easier to control, maintain, and improve. Their contributions are why mobile banking, online stock trade, and cryptocurrency exist today!

So, why is financial technology so important? Consider this: studies show that over 81% of Americans use a smartphone. That’s around 270 million people in the country! Beyond smartphones, many of us own laptops, tablets, and other devices in our daily lives.

With financial technology, we can access our money and make important choices on the go. Whether that’s making investments or paying bills, financial technology can do so much more than imagined!

What are some amazing breakthroughs in financial technology?

Off the top of your head, what comes to mind when you think of “financial technology”? Many of you might say cryptocurrency, NFTs, or online banking. However, there are even more amazing breakthroughs happening as we speak. Let’s look into the future of financial technology with these five incredible inventions!

1. Financial AI

Before the world falls to Skynet and robots take over the world, it’s nice to know that financial technology and artificial intelligence (AI) are working together! All kidding aside, AI has the potential to change the way your bank does business. For example, AI can be programmed to better safeguard your accounts. They’re also used in making financial forecasts and analyzing existing money trends.

Another great way that AI can help financial technology grow is through machine learning. Automated models can be developed and trained to handle any and all concerns. From privacy protection to expense tracking, AI can a great tool to help you keep cash flow safe and steady!

2. Blockchain

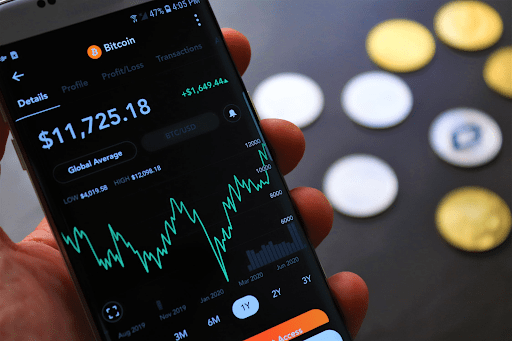

Cryptocurrency is an amazing— albeit divisive— example of financial technology. However, while the product itself has its own flaws, one of its biggest strengths is another kind of financial technology: blockchain. It’s one of the most-cited reasons that experts and investors alike see cryptocurrency as the future.

So, what is blockchain? Simply put, it’s a digital ledger that uses a series of decentralized data to keep track of all finances. Think of it like a virtual trail of records. However, what makes this financial technology so special is its security. Blockchain records use cryptography to ensure that every individual data block cannot be altered. When used by banks or government institutions, these records can help finance be more transparent and better protected!

3. Robotic process automation (RPA)

Robotic Process Automation, or RPA, is all about choices. This type of financial technology operates by using structured data and responses to help process information. Think of it like a digital game of logic, where the robot learns “if this happens, then this happens”.

What makes RPA so intriguing is that it can be programmed to do daily, routine actions quickly. For example, this financial technology can use a series of questions to help investors on a stock trading platform determine their risk profile. It can also automatically process key transactions when certain conditions are met. It’s like having a digital assistant wherever you go!

4. Virtual/augmented reality

When you hear of virtual or augmented reality, you might imagine video games or holograms. However, did you know that VR and financial technology can work together? Companies have been looking for ways to incorporate virtual reality into the financial game. For instance, Meta plans to use VR to create a “metaverse” where transactions and real estate can occur through a digital market!

5. Cloud computing

The old saying “having your head in the clouds” might be interpreted differently now. Thanks to the financial technology of cloud computing, you can store all data processes and information through the Internet. Unlike traditional servers, cloud computing can store tons of information in a digital space.

Typically, people use cloud computing to store data and information off-site. For example, Google Drive can keep all your files with online cloud storage for easy access and use. However, financial technology plans to use cloud computing to help make access easier. Imagine being able to secure all your passwords and information while still being able to use it when needed. It’s a crazy future, but you’d be surprised how close that reality could be!

How do I properly use financial technology for myself?

Financial technology, including the five mentioned above, is going to be a game changer. In fact, a Global Newswire study predicted that the financial technology sector will balloon to a staggering $124.3 billion by 2025!

That said, you might be overwhelmed by all those changes. If you’re worried about how you can use financial technology, fret no more. Here are some key tips to help you understand financial technology and its advantages!

Research all options and how they work.

Financial technology might be the future, but it’s still in development. Even now, there are hundreds of apps and patents trying to explore new ways to handle finances. If you want to play it safe, start by researching all options and how they work.

Focus on your habits first.

Financial technology can help you make big money moves with a few clicks or taps. That said, it’s not going to have the final say. There’s a reason why apps always ask if you’re sure about a choice; ultimately, no matter what program you use, you’re the one in charge.

If you want to use financial technology to improve your life, focus on your spending habits first. A banking app won’t be the one to change your impulse purchases or reckless investments. You have to take control and change your spending habits for the better. Only then can you maximize financial technology to its fullest potential!

Make financial technology a tool, not an answer.

Financial technology and all the previously mentioned breakthroughs are like hammers and nails. Even if you get the best version, you’re the one who makes the choice. Always remember that these programs and apps are meant to help your financial life, not dictate your choices. An AI can only learn so much, and it can’t make decisions like humans can. Sometimes, even the silliest decisions can be the right move. If you want to make the most of financial technology, always remember that you’re the boss!

Takeaways:

- Stephen Hawking’s quote about adapting to change perfectly encapsulates the rapid growth of financial technology (fintech) over the past decade.

- Fintech improves financial services, facilitating the creation of platforms for mobile banking, online stock trading, and cryptocurrencies.

- The ubiquity of smartphones and other devices allows fintech to provide convenient and on-the-go financial management solutions.

- Five key fintech breakthroughs include Financial AI, blockchain, Robotic Process Automation (RPA), virtual/augmented reality, and cloud computing.

- Financial AI uses machine learning to enhance financial forecasts, safeguard accounts, and manage expenses.

- Blockchain, a secure and transparent digital ledger, provides the foundation for cryptocurrencies and has broader applications in finance.

- RPA automates routine tasks, efficiently processing information based on pre-determined conditions.

- Virtual and augmented reality are being explored in fintech, enabling immersive experiences like the “metaverse” for digital transactions.

- Cloud computing in fintech allows vast amounts of data to be stored and accessed via the Internet, increasing flexibility and accessibility.

- To best utilize fintech, individuals should research options, focus on personal financial habits, and view fintech as a tool rather than a solution.

- The fintech sector is expected to reach $124.3 billion by 2025, indicating its increasing importance and influence.

Share this content :

Copyright © 2023 Munif Ali. All rights reserved.